Unlocking the Potential of SOL Pay: A Comparative Analysis Against PayPal and Its Emergence as the Future of Payment Processing

I. Introduction

PayPal, a transformative innovation led by visionaries like Thiel, Levchin, and Musk, reshaped everyday transactions during the Web 1.0 and Web 2.0 eras. Today, the financial world anticipates another groundbreaking shift with SOL Pay, integrating NFTs and Web 3.0. This article explores SOL Pay's potential, rooted in the Solana blockchain, touted as the future of payment processing. Is it poised to be the Visa or PayPal of Web3? We delve into its mechanics, capabilities, and let you decide.

II. SOL Pay: Revolutionizing Payments

A. The vision of SOL Pay

Solana Pay transcends the conventional notion of a crypto payment platform. Head of Payments at Solana Labs, Sheraz Shere, emphasizes a broader vision for Solana Pay—a vision where all currencies exist on-chain, facilitating a diverse array of transactions. This forward-thinking perspective aims to create a versatile ecosystem, enabling a wide range of financial interactions. By offering a seamless and superior blockchain-powered payment experience through easy integration, Solana Pay strives to empower businesses and users alike.

B. Development and partnerships

SOL Pay's journey towards revolutionizing payments is spearheaded by Solana Labs, a leading force in blockchain technology. Solana Labs has orchestrated strategic partnerships and collaborations to bring SOL Pay to the forefront of the payment processing arena.

Key Partnerships: Solana Labs has strategically partnered with prominent entities such as CircleCheckout.com and Sitcon, harnessing their expertise in payments processing and digital commerce. These partnerships provide a strong foundation for the development and adoption of SOL Pay.

Digital Wallet Integration: SOL Pay's accessibility is enhanced through seamless integration with popular digital wallets, including Phantom, FTX, and Slope. These integrations empower users to effortlessly make digital payments using SOL Pay, extending its reach across a diverse range of platforms.

Economic Viability: SOL Pay is designed to be economically viable for businesses of all sizes. Its ability to facilitate transactions for fractions of a penny makes it an attractive proposition, especially for small and medium enterprises looking to minimize transaction costs.

C. Advantages of SOL Pay for businesses and users

In a world where 73% of businesses recognize the significance of accepting digital payments, SOL Pay positions itself as a future-ready solution. The development and partnerships behind SOL Pay are driven by a set of compelling advantages that redefine the payment processing landscape:

Low Transaction Fees: SOL Pay offers businesses and customers the benefit of minimal transaction fees, often amounting to less than a cent per transaction. This cost-efficiency is a game-changer, particularly for microtransactions and everyday payments.

Real-Time Access: One of SOL Pay's standout features is its provision of real-time access to funds. By eliminating intermediaries like banks, SOL Pay empowers businesses to access their earnings instantly, enhancing liquidity and financial control.

Mitigating Chargebacks: SOL Pay's architecture is designed to prevent chargebacks, a common challenge faced by merchants. This mitigation not only reduces the financial impact of disputes but also streamlines the payment process.

IV. Merchant-Customer Interaction

A. Two-way Communication Channels and Transparency in SOL Pay

SOL Pay introduces a transformative approach to merchant-customer interaction, emphasizing transparency and fostering two-way communication channels.

Unlocking Two-Way Communication: SOL Pay empowers merchants to establish two-way communication channels with their customers. This innovative feature enhances transparency and trust in transactions, offering a level of engagement that goes beyond traditional payment methods.

Privacy-Preserving Transactions: Detailed transaction reports in SOL Pay include critical information such as wallet destination, currency type, transaction amounts, and customizable text fields. Importantly, these details are kept entirely private from the broader network, ensuring that both customers and merchants can transact with confidence and discretion.

B. Detailed Transaction Reports for Businesses and Customers

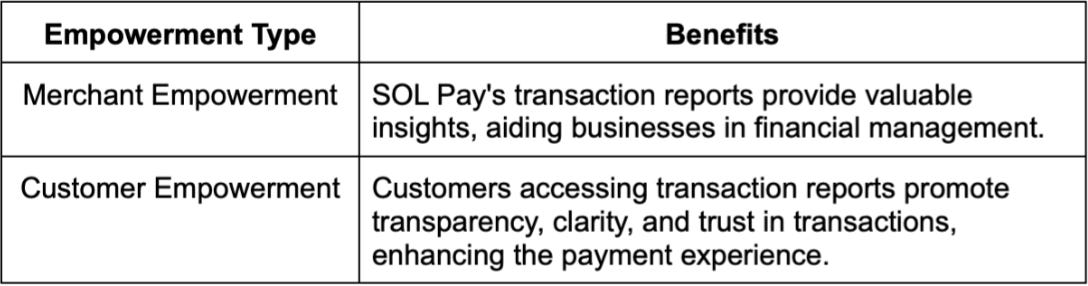

SOL Pay places a premium on transparency and accountability through comprehensive transaction reporting, benefiting both businesses and customers.

V. SOL Pay use cases

A. Open Invitation for Innovation

Sheraz Shere, the head of payments at Solana Labs, extends an open invitation to the entire fintech community: "I encourage everyone who works in fintech to evaluate and build on this protocol." The exceptional aspect of SOL Pay is its inclusivity – it's accessible to all, whether you're a merchant, payment service provider (PSP), e-commerce platform, startup, solo developer, point-of-sale (POS) provider, or acquirer. Together, we have the opportunity to collectively shape the future of commerce by harnessing the potential of SOL Pay.

B. Diverse Possibilities with NFTs

Developers operating within the Solana ecosystem are encouraged to explore an array of use cases for SOL Pay. The Solana community actively invites proposals for changes and updates, fostering an environment of continuous innovation. Beyond revolutionizing crypto payments, SOL Pay holds the capacity to seamlessly facilitate both physical and digital transactions through the integration of non-fungible tokens (NFTs). This opens the door to entirely novel commerce experiences and possibilities, bridging the gap between the physical and digital realms.

C. Redefining Payments for Web 3.0

While SOL Pay is making significant strides, it's important to note that it doesn't aim to directly compete with established giants like Visa or Mastercard. Rather, its mission is to redefine the payment landscape. By championing decentralization, permissionlessness, and peer-to-peer transactions, SOL Pay is at the forefront of ushering in a new era of commerce experiences in the age of Web 3.0. For developers building decentralized applications on Solana, seamless integration of SOL Pay empowers them to be pioneers in shaping the future of payments and commerce.

D. Opportunities for developers and new use cases

Tourist-Merchants Use-Case:

Opportunity: In tourist-heavy cities like Dubai, Solana Pay offers an efficient way for tourists to spend USD as USDC, saving on currency exchange fees. Merchants can embrace crypto, reducing transaction costs.

Domestic Payments: To unlock domestic payments, Solana Pay can introduce localized features like local stablecoins and user-friendly point-of-sale solutions.

Luxury Brands:

Opportunity: Luxury brands in the Middle East can benefit from adopting Solana Pay to attract crypto-savvy clientele, leading to increased sales and brand visibility.

Benefits for Solana Pay: Onboarding luxury brands can bring high-value users, large transaction volumes, and set an example for smaller merchants.

Remittances:

Use Case: Solana Pay can revolutionize remittances, particularly in regions with expatriate workers, by partnering with cashout points and exchanges to offer cost-effective solutions.

Solana Pay's Role: Solana Pay can partner with cashout points and exchanges, optimizing costs and offering a more cost-effective remittance solution. Collaboration with exchanges in regions with a high number of expatriates can facilitate peer-to-peer crypto transfers.

Solana Pay provides diverse opportunities for developers to innovate across different sectors and markets.

VI. SOL Pay vs. PayPal: A Comparative Analysis

Below, we provide a comparative analysis of these platforms, considering key aspects such as technology, transaction speed, integration with cryptocurrencies, environmental impact, chargebacks, adoption, and their overarching visions.

Additionally, SOL Pay's accessibility for DApps developers and traditional retailers, along with its potential to revolutionize crypto payments, aligns with the comparison to PayPal, which transformed traditional online payments.

VII. Conclusion

In conclusion, SOL Pay is a promising contender in the digital payment landscape, offering low-cost, real-time transactions, and innovative features. It has diverse use cases, from tourism to remittances and luxury brands. While excelling in speed and cost-effectiveness, it's still emerging in terms of adoption when compared to PayPal, the established payment giant. The choice between them depends on specific needs and preferences. SOL Pay has the potential to disrupt the industry and challenge PayPal's dominance as it continues to evolve.

VIII. References

https://gadgetstouse.com/blog/2022/06/14/solana-pay-explained-everything-you-need-to-know/

https://yashhsm.medium.com/solana-pay-use-cases-and-winning-the-asian-markets-gtm-ecded3eabd9c